Is Mobile Home Parks a safe investment today?

Why I Made the Leap From Single Family to Multifamily Real Estate Investing

Let’s get into the reasons why real estate investors shift from single family investing to multifamily investing.

I want to start off with my story.

I started in the industry in 2007 when things were not going so well.

I bought my very first property with no money out of pocket. I actually had negative funds in my bank account—I over-withdrew and was just not being financially smart. And my credit score wouldn’t even register when you pulled it.

I had a ton of excuses with regard to why purchasing real estate may not be possible but was fortunately able to find someone who complemented my weaknesses. So, that’s how I was able to buy my first deal—and was able to get up to 5 single families at one point!

Then, it became very management-intensive having all of those properties. So, I took a step back to decide: Where do I want to be long-term?

And it just made the most sense to shift to multifamily. This was in 2010.

So, these are the reasons that I believe are investors’ “whys” in terms of making the shift—and why I ultimately did. And there are several benefits to taking the leap.

Here are a few.

The Benefits of Shifting From Single Family to Multifamily Real Estate

1. Save Time

The first perk is just saving time. I was able to get up to 150 single families, and that was a lot in terms of management.

Also, when I think back about acquiring my first 12-unit apartment building, the time I spent doing that was a lot less than the time I spent on 5 single families. I certainly think I got a better ROI on time with the multifamily asset. It was one buyer, one transaction, versus with single families, it was multiple one-off deals or maybe two to three at a time. But that was a lot of transactions and volume involved with that.

2. More Control

The second is more control. What I mean by more control is a lot of multifamily is driven by NOI, which is net operating income. Buyers who are coming in who are buying that asset look at it as a business. So for you as an operator, if you are able to drive that net operating income, then that directly correlates in terms of the value that you’re able to get out of that.

With single family, a lot of the time it’s more of “this one across the street is going for this, so that’s going to be the value of my property.” ARV is heavily weighted on comparable properties in the area, as opposed to NOI.

So, there’s that on having more control.

3. Economies of Scale

And the last but not least, which is by far one of my favorites, is the economies of scale.

An investor friend of mine just recently bought 100 units. That was the largest to date. Feel great about that, but the hard work is even more to come.

But with that I have 100 units in one location and they are able to have an onsite manager, as well as multiple maintenance techs. This is in stark contrast to having all those single families that were scattered throughout.

There are so many more benefits that you’re able to get when you have midsize to larger apartment buildings. It’s much more management efficient.

So, those are the reasons why I see single family investors shifting over to multifamily and why it is so much more beneficial a space to be in.

Is Owning Property Really the Best Way to Make Money Investing in Real Estate?

It seems that many of us learn about the “American dream” of homeownership at a very early age, and for some, that dream can stick with us.

When I was working in real estate sales and as a contractor, my ultimate goal was to own a LOT of real estate. The more, the merrier!

Not to be a Scrooge, but now I’m starting to question the premise that “owning more is better.” Is ownership really the only, or even the best, way to make money investing in real estate? Or are there better ways?

Control vs. Ownership

As I get older and hopefully wiser, I wonder if the best way to invest in real estate is always buying and holding properties, along with all the management and maintenance that comes with it. Or are there better ways to invest that are just as effective and efficient—with less risk? Is ownership really the dream we’re after—or is it more about control?

Today, I’m heading down the path of controlling more assets than I own. Especially as I’m approaching my retirement years, I’m always looking for better ways to simplify my life and my investing.

Here are some of ways you can mix up “pure” ownership with other ways of controlling deals.

Trusts

Of course, some things make more sense to own outright, like shares of the business you run. But there are many things we can control without owning and still enjoy a lot of the benefits of without all the risks that could come along with ownership.

Take trusts, for example. Holding real estate inside a trust could be the perfect entity structure for an investor because “you” don’t own it (the trust does). And you’re not even the trustee or the beneficiary, yet you could still be the manager and control the bank accounts. In other words, the trust takes on the risks of ownership while you maintain the actual control over the assets owned by the trust.

As I’ve always said, “The best form of asset protection is not to own anything.”

Fractional Ownership

Another great way to invest in real estate without taking on too much risk is to only own part of the deal.

For example, you could have majority ownership (and control) but bring in a high income or high net worth partner to sign on the financing for your deal (e.g., apartments, mobile homes, student housing, etc.).

So, why would they be willing to do that? Well, if you found the deal, ran the value-add renovations, and were responsible for all the property management and maintenance, they may be more than happy to do their part by signing on the loan for a nice chunk of ownership with little to no work.

Another way that comes to mind is if you passively, usually for a preferred return with or without upside, invest in a company or fund that invests in real estate. Now, this can take many forms. Some fund investments have tax advantages (i.e., depreciation), like apartment funds, and some don’t have many tax advantages, like note, tax lien, or hard money funds.

Even being a private money lender is a great way to indirectly invest in real estate, without a ton of work or risk, for that matter.

Control Without Ownership

Other than managing a trust, the next big way to have control of real estate without ownership is through options. For example, doing a sandwich lease option is the epitome of being able to capitalize on a deal you don’t even own.

Let’s say you find a property you can rent for $700/month with a $1,000 deposit for three to five years with the option to buy it for below asking price (i.e., sales price minus a commission, offering, say, $75,000 on an $80,000 asking price). Then, you can turn around and sell it on a rent-to-own lease option to a buyer/tenant for, say, $950/month with a $3,000 deposit with the option to purchase in two to three years for $95,000.

Make the seller handle any repairs over $300 and the new tenant/buyer fix anything up to $300, and you’d probably have a home run on your hands.

Downside of a deal like that? The worst-case scenario is that you’d return the property back to the seller at the end of the term.

Control With Ownership

That said, it is also possible to have control with ownership in a way where there is very little risk. A perfect example of this is buying a property “subject to” the mortgage. Because the loan on the property that you take over is not in your name, your risk is very limited.

Although the lender could call the loan, the biggest risk would be if you have a lot of money tied up in a renovation or if you couldn’t liquidate the property quickly enough. If you have enough reserves or access to capital, this may not be a problem.

Time to Get Creative!

The list of strategies for controlling (and benefitting from) real estate without owning it outright goes on. Don’t just settle for what is commonly done or what you’re already familiar with.

The Pros and Cons of Investing in Rent-Controlled Properties

The mention of rent control is enough to make most apartment investors shudder—the notion of artificially capping rents flies smack in the face of American capitalism. But there are several misconceptions about rent-controlled properties. For some, they can be a great addition to their investment portfolios.

In this article, we look at the pros and cons of investing in rent-controlled properties. Let’s actually start with the cons, as these tend to be the least controversial.

The Cons of Rent Control

Rent control regulations can be difficult to navigate.

Rent control regulations can be regulated at either the city or state level—or both. The state of California, for instance, allows rent control, but the decision is made at the local level as to whether to adopt a rent control policy.

It’s not uncommon for two adjacent communities to have different policies, one with rent control and the other not. The landscape is continuously evolving; investors need to track these regulations closely as there are routinely efforts (like ballot measures) to change policies.

Your ability to increase rents is capped each year.

Depending on the community, it’s possible that the rent control policy will prohibit landlords from raising rent more than 2 percent each year–in other words, rent increases essentially just keep pace with inflation. This may be completely out of line with market averages, particularly in hot-market cities, where rents have experienced double-digit increases over the past several years.

This ceiling can make deals less attractive to investors in search of strong cash flow.

Rent controlled properties experience lower turnover.

Typically, low turnover is a good thing as far as apartment investors are concerned. However, some rent control policies stipulate that rents are capped each year until an apartment becomes vacant, at which point the landlord can increase the rent to market rate and then the new cap takes place each year thereafter under the existing tenancy.

To bring units to market rate, they must turn over at least every few years–but tenants in rent-controlled units tend to stay longer than average (sometimes 30-plus years!).

There’s less incentive to improve properties.

One unintended consequence of rent control is that, unable to increase rents, there’s no incentive to invest in a property beyond routine repairs and maintenance. Over time, this can lead to a deterioration (and therefore, value) of the property.

If you decide to sell in the future, your pool of buyers may be smaller.

Given the challenges associated with rent-controlled properties, some investors will never even look at these deals. This inherently shrinks the pool of potential buyers when it comes time to sell.

The Pros of Rent Control

Rent-controlled properties tend to have lower acquisition costs.

Investors typically use the current rent roll as a major factor when determining the value of a property. Rent-controlled properties, particularly if multiple units are below market rates, are therefore valued lower than what the free market would bear.

This results in lower acquisition costs, which may be a good way for an investor to enter a market they’d otherwise be priced out of by investing in a rent-controlled property.

You CAN increase rents.

Contrary to popular belief, landlords CAN raise rents in a rent control environment—they’re just limited as to by how much each year.

For instance, Oregon just passed a statewide rent control ban this past year that caps rent increases at 7 percent plus inflation annually. That’s a total of 10.3 percent this year. Statewide, rent growth has slowed to less than 2 percent a year since 2016, so the new law makes little difference to landlords looking to increase rents.

There are usually policies in place to challenge the cap.

No community wants to see their housing stock decline. To prevent this, most rent control regulations contain provisions that allow investors to challenge the cap when making substantial renovations or improvements to the property.

Rent-controlled properties tend to have consistent cash flow.

Because rents are lower, and because tenants tend to stay in place longer, rent controlled properties tend to have consistent cash flow. What’s more, tenants in rent-controlled properties are less likely to move out during a downturn, which helps investors weather the ups and downs that are inevitable over the course of multiple real estate cycles.

Ultimately, the decision as to whether to invest in rent-controlled properties is a personal one. Rent control regulations can vary so widely–from highly restrictive policies in cities like New York and Los Angeles, to the more flexible rent control policy recently adopted in Oregon.

Anyone considering investing in an area with rent control should spend the time needed to understand the nuances of the policy. One misstep in violation with a rent control law could cripple an otherwise promising investment.

Recession Watch: Are We Overbuilding in the U.S.?

The U.S. economy has been growing for 11 years, making the current expansion the longest in its history. So, when is the expansion going to end?

This is the question on everyone’s mind. Although we can’t predict when the recession is going to start, we can assess the market risk intellectually using statistics and then prepare for it strategically.

With that, let’s discuss the current status of the housing market and how to minimize risk and not lose money.

The Housing Market

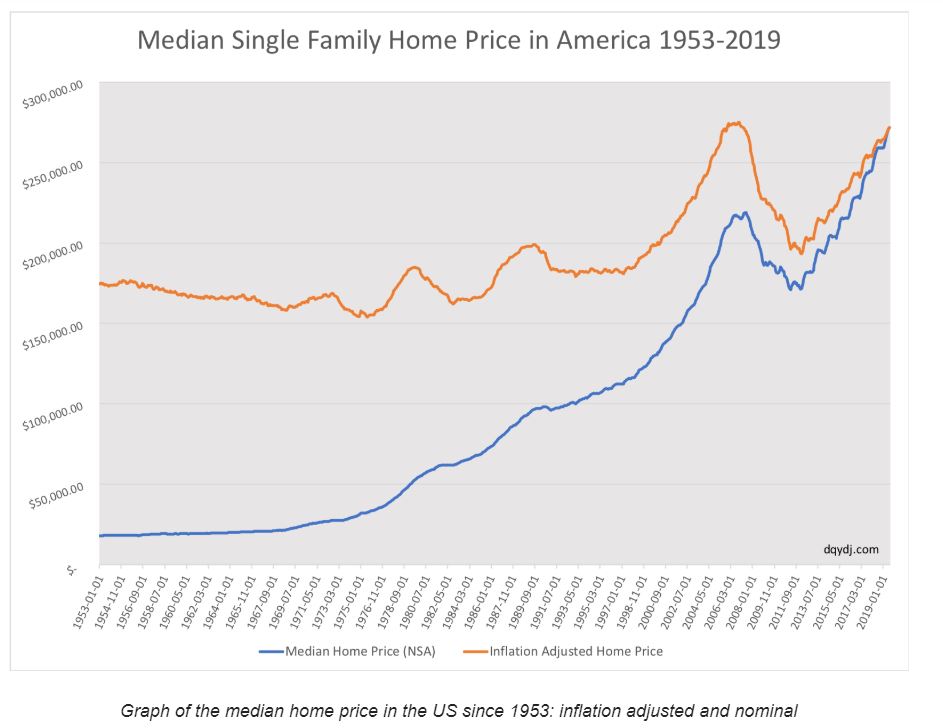

Median Historical Housing Price

Figure 1. Median Single Family Home Price in America 1953-2019

Based on the graph above, our inflation adjusted home price in the beginning of this year just reached the pre-recession high. One might think that we’re in a bubble, and it’s time to sell. On the contrary, I think home values still have room for growth, since they typically increase in the long-term, and we just spent the last decade recovering!

“Median housing price just reached pre-recession high” is a scary fact, but let’s look at this from a different perspective. Our current S&P 500 stock price is 3150; the previous peak was 1550 in 2007. It’s double what it used to be!

Even though the S&P 500 price doesn’t account for inflation, the difference is still much greater than that of housing. If the current housing market were in a bubble, then the stock market is in a way worse situation. Not to mention the Nasdaq Composite is currently triple of the previous peak.

Are We Overbuilding?

The short answer is NO! We’re actually not building enough. Here’s why!

Figure 2. Housing Units Completed Analysis (1970-2018)

The number of housing units we built in 2018 was 1,185,000, compared to 1,979,000 in 2006. We are currently building at 60 percent of the pre-recession rate—not to mention that we now have a higher population.

By adjusting for the population size, the number of housing units completed in 2018 was only 0.36 percent of the population, compared to 0.66 percent in 2006—a drastic decline in the building rate per capita.

The economy has been doing well and our interest rate is at a record low, so why are we building at a slower pace?

Although our interest rates are at a historical low, the more conservative underwriting by banks, such as debt coverage (DCR) and loan to value ratio (LTV), combined with our cautious mindsets, have limited the pace of growth.

Conclusion

Since housing prices have more room for growth, and we haven’t saturated the housing market by overbuilding, I’d argue that housing in the U.S. is still at a healthy state. However, this doesn’t mean that we won’t have a recession. There are still other factors that can cause our economy to decline, which will inevitably impact real estate.

How Can Real Estate Investors Reduce Risk

Warren Buffett’s No.1 rule: “Never lose money.”

Here are some very important tips that you should follow, especially at this stage of economy.

Local Absorption Rate

Although we concluded that U.S. housing in general is not overbuilt, that doesn’t mean this is the case in every city. Some cities are more overheated than others, so try applying the two methods I presented earlier (in Figure 1 and Figure 2) to the cities that you’re interested in.

In additional to that, you should look at the local absorption rate for both single family and multifamily. If you notice that local housing is overbuilt, then start underwriting more conservatively by using more stress tests.

Single Family

For single family, it’s a red flag if you see absorption rate lower than 15 percent. That means less than 15 percent of the single family supply was sold in the last 30 days.

For example, in a market where there are 100,000 houses available for sale, only about 15,000 houses were sold in the last month. This is a 15 percent absorption rate

When the rate is lower than 15 percent, the local supply is much higher than the local demand. This is now a buyer’s market, which means the selling price is usually below the listed price. The local housing economy is starting to cool off.

Multifamily

The metric for multifamily is a bit different, because you are not selling commercial properties on a daily basis. Instead of looking at how fast the commercial properties are selling, you want to understand how fast the rental units are being leased out.

For multifamily, use the absorption period, which is defined as the amount of time it takes to lease out the current vacant supply. If the absorption period is more than three years, then it’s a sign of oversupply.

For example, Los Angeles currently has 21,000 lease-up vacancies, and the average annual absorption is 10,000 units, which means the absorption period is about two years.

Reducing rent is another sign of oversupply. When the apartments are not leasing out fast enough, rents will naturally decrease to retain or attract tenants. Declining rent is not a good sign for the housing economy.

Buy for Cash Flow

One of the common ways to lose money in real estate is selling the property while the market is down. Obviously, nobody wants to sell at a loss, but there aren’t many other choices when a house is losing money or when the property needs to be refinanced.

To reduce the risk of this from happening, you want to make sure that your property’s debt coverage ratio (NOI divided by debt service) is still above 1.4 after several different stress tests. The stress test could be lower economic occupancy, higher interest rate, or lower rental growth.

You also want to avoid using cash flow for renovations. If you’re renovating a house or an apartment complex, make sure you raise equity for this, and add an additional 15 percent contingency into your budget.

To avoid having to refinance your property, talk to your loan officer, and try to secure a permanent loan as soon as you can.

So… Should You Keep Investing?

The best strategy is to make good investments consistently overtime. It’s very difficult to predict the next recession or to quickly adjust your real estate portfolio.

The bottom line is: even though the next recession will hurt your property’s value, it’ll eventually recover. Stress test and make sure you have enough cash flow to cover the expenses and loan payment even during a market downturn!

This blog is meant purely for educational discussion of finance. It contains only general information about financial matters. It is not financial advice, and should not be treated as such.

How to Be a Rockstar Landlord: 6 Tips for Success

How would you like to work 168 hours a week, never travel anywhere, and spend your days dealing with the ungrateful, entitled, lowest common denominator of public society?

No?

OK good, me neither. So, today I want to share with you my top tips for AVOIDING that lifestyle while still owning rental properties.

That’s right. You can be a rockstar landlord without being a slumlord — and today, I want to offer six tips for doing just that.

1. Treat Landlording as a Business

Look, you don’t see Howard Shultz making lattes, Mark Cuban playing one-on-one with Shaq, or Donald Trump swinging a hammer.

Why?

Because these people run businesses. And if you own rental properties, you run a business too.

So start acting like it!

Take it seriously.

Build processes and systems that you can follow. Be consistent. Hire stuff out. Be organized. Know your numbers. Stop getting so emotional about everything.

It’s a business — and it’s time you started acting like it.

2. Provide a Great Home

If you want to attract weird tenants, provide a weird home.

But if you want great tenants, provide a great home. Fix the property up right before a tenant moves in. In the words of my friend and fellow landlord Darren Sager, make your home “tenant-proof” by using materials that won’t break down quickly.

Your property doesn’t need to look like Buckingham palace, but it should be clean, durable, and better than average — because that’s exactly the kind of tenant you want to attract.

3. Get to Know Your Fair Housing Laws

If you really enjoy lawsuits and paying big bucks to bad tenants, ignore this tip.

But if you want to remain legal and avoid being called a lot of terrible names in the paper, listen up.

You need to learn what your Fair Housing Laws are.

Fair Housing Laws exist on federal, state, and local levels and are designed to make sure discrimination doesn’t take place against a “protected class.”

Protected classes include race, color, religion, sex, familial status, handicap, national origin, and potentially more depending on your local laws.

While it seems pretty obvious on the surface, sometimes it can be easy to discriminate and not even notice. For example,

“Yeah, this property is on the second floor, so probably not ideal since you have a wheelchair.”

or

“You know, I have another property that might suit you a little better since this is a high-crime area and you are a single woman.”

or

“It’s a small studio apartment, so we can’t allow seven kids.”

Each of these could get you in hot water, so be sure to review your local, state, and federal Fair Housing Laws.

4. Wait — and Don’t Wait — for a Great Tenant

I know, that’s kind of a weird tip, but hear me out.

One of the best tips I ever received when I bought my first rental property was this: Wait for a great tenant. It’s better to have a property vacant longer than rent to someone who will drive you crazy or who you might have to evict.

While this is fantastic advice, I want to amend it.

Don’t just wait for a great tenant to find you. You have to go out and find them!

In other words, take your marketing efforts seriously so you have an endless supply of tenants calling to rent your property. Then pick a great tenant and move them in.

Now, speaking of finding a great tenant…

5. Take Your Tenant Screening Seriously

Tenant screening is one of the most important jobs of a landlord.

Screening is the process you go through to make sure the tenant who has applied is going to be that ideal tenant you want.

Because let’s be honest: People lie. Screening is how you verify they are telling the truth.

When screening tenants, be sure to:

- Run a background check to make sure they aren’t evil minions.

- Check their employment status and verify their income.

- Talk with their previous landlords — because how they’ve been in the past is how they’ll be in the future.

6. Train Your Tenant from Day One

No child is born knowing how to drive a car. You have to train them to be great drivers!

In the same way, you must train your tenant to be great tenants. It doesn’t come naturally to most.

Training involves two aspects:

- First, you must establish rules and guidelines up front. How do they know that blasting punk rock music at 2:00 a.m. is bad if you don’t tell them? This is why a solid lease agreement is so important.

- And second, you must enact punishment if they break the rules.

No, I’m not talking about beating your tenant with a leather whip.

I’m talking about penalties when they break the rules. If they are late on the rent, charge a late fee. If they move a pit bull into your “no pet” rental, make them give it away or face eviction.

Yes, I know it feels weird being the enforcer, but rules benefit everyone, and by being a fair but firm landlord, you’ll gain their respect and have a long-term business relationship with them.

Of course, being firm doesn’t mean you can’t be a good person. Your tenant will respect you and stay for years if you treat them with the respect they deserve. Address maintenance concerns quickly, send a card at the holidays, and follow the Golden Rule — treat tenants the way you would want to be treated.

By following these six tips, you’ll find that landlording doesn’t have to be a drag. In fact, being a landlord can be one of the most rewarding and profitable roles you can play — if you are willing to do it right.

5 Remodeling Materials I Swear By (Perfect for Flips, Rentals—You Name It!)

Remodeling a house can be a huge undertaking! Especially for an inexperienced investor or homeowner who has no clue how to choose materials and selections. There are so many things to consider in terms of remodeling materials. From the budget, to the tastes of the buyer, finishes, color schemes, textures—it’s enough to make anyone’s head spin!

Most of the best and frequent flippers have systems, and repeat them over and over again. This applies to the offers they write, the contractors they hire, and even the materials they use. Becoming familiar with materials not only gives the investor greater control over their budget, it also allows them to make quick and easy decisions on their renovations.

Many of my flips, regardless of the shape, size, or location, follow a very similar system. And I use versatile materials over and over again. Here are five of my favorite materials for any renovation.

Top 5 Materials I Choose When Remodeling Homes

1. Vinyl Plank Flooring

The best thing about vinyl plank flooring is that you can use it in every inch of a house. If you buy one that is waterproof, you can install it in every room in a house. This stuff is incredibly versatile! It is easy to install and great looking, too!

You can buy it for less than $2 per square foot or upwards of $5 per square foot, depending on the quality you are looking for. I’ve had it installed for as little as $1 per square foot, but a good estimate is $2 to $2.50 per square foot for installation. It comes in dozens of finishes and can match any existing color palette or finish.

2. Flat Weave Carpet

This type of carpet is stylish, looks nice, and can be used in indoor and outdoor spaces. This is an easy upgrade for sunrooms, patios, lanais, and even garages. It adds texture and dimension to any space and can fit a variety of décor. This type of carpet comes in various styles, colors, and fibers, as well.

3. Butcher Block Counter Tops

Just like the vinyl plank, the color and texture finishes for butcher block counter tops are plentiful! This material can add dimension, round out selections, or even be considered an “upgrade,” depending on the market. Check out how incredibly different these two kitchens can look using the same materials!

4. “Agreeable Gray” Paint

Gray paint—everywhere! A light gray paint throughout the house with white trim allows for a pristine finish to any renovation. It is bright, sharp, and feels luxurious.

If you want to add an accent wall, just go a shade or two darker, or pick a blue, pink, brown, or even green in the same color family (any paint store or paint department at a hardware store can help you ensure your accent blends with your primary wall color). This ties everything together and can pair well with most counters, cabinets, and tiles.

The photo below was from my first flip. One (perhaps the only!) thing I did right was chose the paint colors. The light gray paint spanned the entire house, and I added one darker accent wall as an upgrade. The gray ties together the flooring, door, and the trim and looks clean, complete, and new.

5. Drop Light Fixtures

Again, just like any materials, these range greatly in price but can add a lot of dimension to a renovation. They also feel luxurious and—if placed right and chosen appropriately—can make a basic renovation go from “blah” to “glam”!

Getting comfortable with the materials and processes can add great peace of mind!

Will Real Estate Agents Be Made Obsolete by 2025?

Real estate agents are on their way out. How can they save themselves? Why is this so important for property investors to watch?

Once upon a time, there was no internet. Real estate brokers had exclusive access to real estate listing data. There was hardly any transparency, scale, or speed in viewing listings, checking comps, and making offers. Everything was offline—and very controlled. Things are completely different now.

In a couple of seconds, buyers can see everything on the MLS, as well as online for sale by owners. They can check comps and market trends. Sellers can even get instant offers for their homes.

Essentially, many of the reasons that real estate agents were needed or had value have vaporized. It’s not unlike many other jobs. Still, this technology shift in the real estate industry is likely to be one of the biggest and most impactful yet.

Disrupted by Technology

If real estate agents fail to separate themselves and find ways to deliver value, they will be disrupted and rendered useless by technology.

Now, don’t get me wrong. I like and respect agents. I even work with a lot of them. Some are very valuable; others not so much. I wish more could save themselves and their careers by seeing how urgent this issue is and making the change while they still can.

There are several ways the real estate industry can do this. One is the old tradition of lobbying, creating new regulations, and using legal battles to protect their turf.

There is no question this is happening, and if it is not, it is a tool that should be used. Real estate groups are one of the most powerful, well-funded, and impactful in this area—though chances are, this may not last forever. Look at how Uber and Airbnb are acing those legal battles while disrupting service industries that never innovated.

Offer Unique Value

The other way to beat this is to strive to offer more value and service. What can you do or offer to add value to buyers, sellers, renters, and agents? Maybe it is a better experience. Or it could be mastering new knowledge or providing more efficiency and profitability than can be achieved alone.

Right now, two of the areas where agents still add value is managing all of the old school paperwork and processes and acting as a buffer from liability. Of course, these factors are likely to be streamlined by technology, as well.

This is all important to watch for real estate investors, too. To sustain success, you have to be using the best and newest technology. You have to anticipate change and strive to offer incredible value beyond just being able to make offers and advertise properties. You also have to operate incredibly efficiently in order to continue to compete.

REASONS WHY REAL ESTATE IS BETTER THAN STOCKS

1) You are more in control. Every physical real estate investment you make puts you in charge as CEO. As CEO, you are able to make improvements, cut costs (refinance now) that rates are back down post now that Trump is disappointing on some of his main promises), raise rents, find better tenants, and market accordingly. Of course you are still at the mercy of the economic cycle, but overall you have much more leeway in making wealth optimizing decisions. When you invest in a public or private company, you are a minority investor who puts his or her faith in management. Sometimes managers commit fraud or blow their companies to smithereens through unwise acquisitions. Nobody cares more about your investment than you.

2) Leverage with other people’s money. Leverage in a rising market is a wonderful thing. Even if real estate only tracks inflation over the long run, a 3% increase on a property where you put 20% down is a 15% cash-on-cash return. In five years you will have more than doubled your equity at this rate. Stocks, on the other hand, generate roughly 7% – 9% a year including dividends. Leverage also kills on the way down, so remember to always run the worst case numbers before purchase.

-

Archives

- May 2021 (1)

- April 2021 (1)

- June 2020 (2)

- March 2020 (2)

- February 2020 (3)

- January 2020 (4)

- December 2019 (8)

- November 2019 (2)

- October 2019 (3)

- July 2018 (1)

- April 2018 (2)

- May 2016 (1)

-

Categories

-

RSS

Entries RSS

Comments RSS